Convertibles

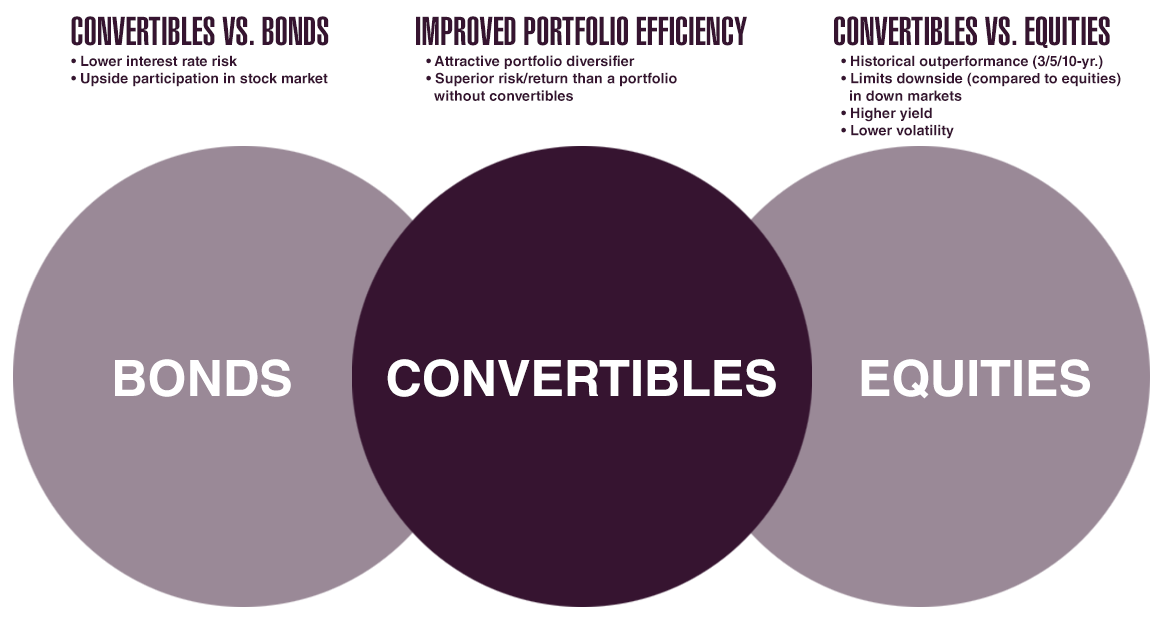

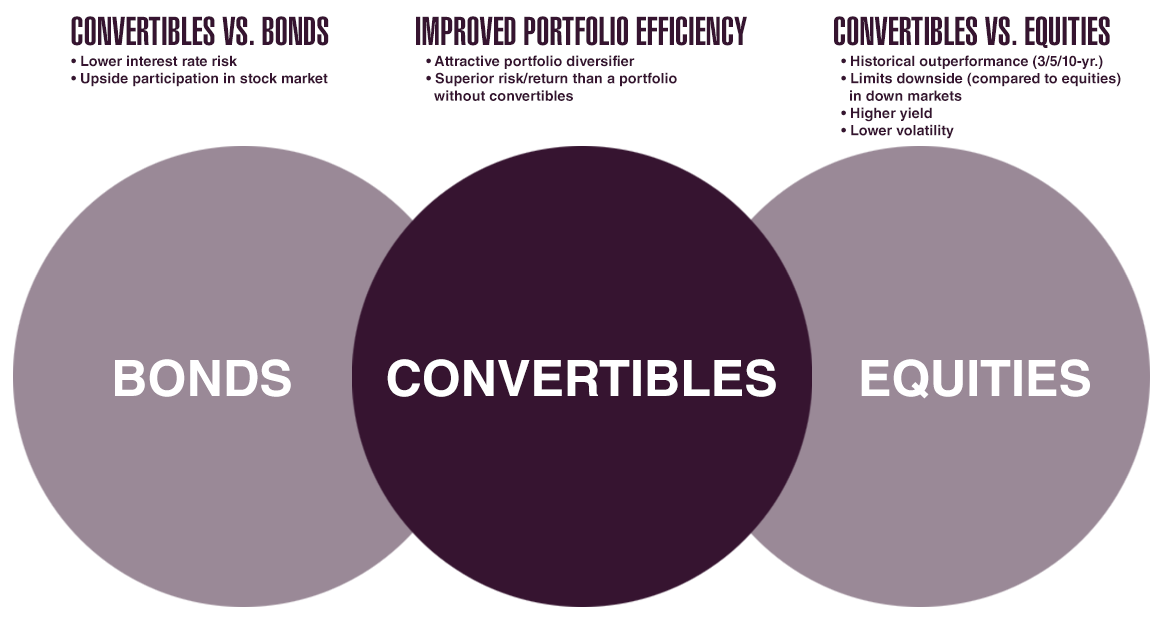

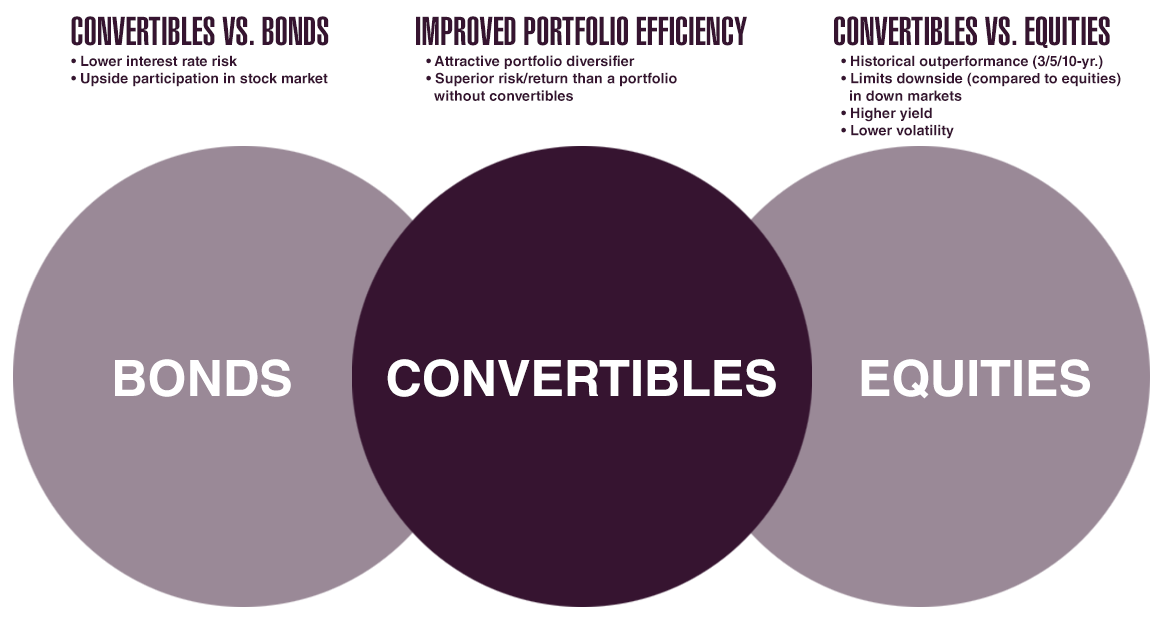

Convertible securities are unique in that they combine features of both equity and debt securities. At the time of issue, a typical convertible security functions like a bond: it pays interest at specified intervals, up until it matures or is repaid. The difference is that instead repaying principal in cash, as a bond would do, it typically offers the investor the option of receiving either cash or a stated number of shares of the issuer’s stock.

The advantage here is evident: in times of rising equity prices, the value of a convertible typically will rise, because the shares in which it would be repaid are worth more. In times of flat or declining equity prices, however, a convertible typically offers good downside protection. The value of the security is protected by the option of receiving the principal back as cash rather than shares.

Convertibles are a long-established and widely recognized type of security. So why don’t investors talk about them very much? The main reason is that the market for these securities is not large enough to be of interest to financial services giants. However, at its current size, the global convertible securities market is more than adequate in terms of liquidity and breadth of choice for investment managers who have the knowledge to specialize in this market.

Comparing the Performance of Convertibles Versus Equity and Bond Indices

Long-term returns of convertibles have offered competitive returns with less volatility than equity markets.

Returns and Volatility Over 20+ Years

(Annualized from 12/30/1994 to 10/31/2025)

|

| Asset Class |

Index |

Annualized Return |

Standard Deviation |

Sharpe Ratio |

| Convertibles |

BAML All US Convertibles Index (VXA0) |

11.2% |

12.6% |

0.49 |

| Large Cap Equity |

S&P 500 Total Return Index (SPX) |

13.2% |

15.1% |

0.54 |

| Small Cap Equity |

Russell 2000 Total Return Index (RTY) |

10.8% |

20.0% |

0.36 |

| Fixed Income |

Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU) |

5.5% |

4.1% |

0.08 |

Source: Bloomberg

Convertibles Performance vs Equity and Bond Indices

(Cumulative total return through 10/31/2025)

|

| Asset Class |

Index |

One Year |

Three Years |

Five Years |

Ten Years |

| Convertibles |

BAML All US Convertibles Index (VXA0) |

22.3% |

47.4% |

56.3% |

184.6% |

| Large Cap Equity |

S&P 500 Total Return Index (SPX) |

21.4% |

84.5% |

125.1% |

291.2% |

| Small Cap Equity |

Russell 2000 Total Return Index (RTY) |

14.4% |

40.1% |

72.0% |

144.0% |

| Fixed Income |

Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU) |

6.2% |

17.8% |

-1.2% |

20.7% |

The S&P 500 Total Return Index is a market-cap weighted equity index of 500 large companies in the U.S. and is regarded as a leading proxy for the U.S. stock market.The BofA Merill Lynch All U.S. Convertibles Index (VXA0) tracks the performance of the publicly issued U.S. dollar denominated convertible securities of U.S. companies. The Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU) is a broad-based index that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market and is a commonly used benchmark for the broad investment grade market. Source: Bloomberg

Investing in Convertible Securities involves risk. The value of a convertible security is a function of its “investment value” (determined by its yield in comparison with the yields of other securities of comparable maturity and quality that do not have a conversion privilege) and its “conversion value.” The investment value of a convertible security is influenced by changes in interest rates, the credit standing of the issuer and other factors. The conversion value of a convertible security is determined by the market price of the underlying common stock. A convertible security generally will sell at a premium over its conversion value by the extent to which investors place value on the right to acquire the underlying common stock while holding a fixed-income security. A convertible security will generally be subject to redemption at the option of the issuer at a price established in the convertible security’s governing instrument. If a convertible security is called for redemption, investors will be required to permit the issuer to redeem the security, convert it into the underlying common stock or sell it to a third party. Any of these actions could have an adverse effect on investors ability to achieve their investment objective. There are numerous other risks to consider with respect to convertible securities, including, without limitation, the following: Default Risk/ Credit Risk: Default risk refers to the risk that a company who issues a debt security will be unable to fulfill its obligation to repay principal and to pay interest in a timely manner. The lower a bond is rated, the greater its default risk. While many large companies issue convertible securities the universe of convertible security issuers is dominated by small to medium-size companies, which often have below “investment grade” credit ratings. In addition, the credit rating of a company’s convertible securities is generally lower than that of its conventional debt securities. Convertible securities are normally considered “junior” securities – that is, the company usually must pay interest on its conventional debt before it can make payments on its convertible securities.; Interest Rate Risk: Interest rate risk is the risk that an investment will decrease in value as a result of an increase in interest rates. Generally, there is an inverse relationship between the value of a debt security and interest rates. Therefore, the value of convertible securities may decrease in periods when interest rates are rising. In addition, interest rate changes normally have a greater effect on prices of longer-term convertible securities than shorter-term convertible securities.; Synthetic Convertible Securities Risk: The value of a synthetic convertible security will respond differently to market fluctuations than a convertible security because a synthetic convertible security is composed of two or more separate securities, each with its own market value. In addition, if the value of the underlying common stock or the level of the index involved in the convertible component falls below the exercise price of the warrant or option, the warrant may lose all value.; Sector Risk: There is the chance that returns from the economic sectors in which convertible securities are concentrated will trail returns from other economic sectors. As a group, sectors tend to go through cycles of doing better – or worse – than the convertible securities market in general. These periods have, in the past, lasted for as long as several years. Moreover, the sectors that dominate this market change over time.