Community Banks

The U.S. banking sector ranges from financial giants, such as Bank of America and JP Morgan Chase & Co., to local community banks with one branch. At Cutler, we tend to focus on the smaller end of banking – community banks that are seeking to grow their footprint.

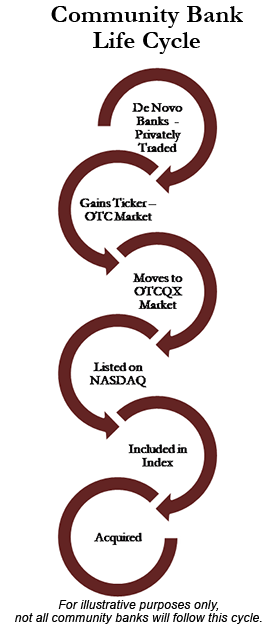

Our investment team has extensive experience in the community bank space, including founding de novo start-ups; managing as bank presidents; serving as board members; and, working as lenders, auditors and analysts. We have been actively engaged with community banks throughout their lifecycle: from formation of several de novo banks through their sale.

As a result, we have a team focused on identifying value investment opportunities amongst an under-researched market that is too small to be on the radar of most large financial services firms. But its opportunities are real, and at Cutler we have years of experience investing in this market and believe opportunities will continue to exist here for years to come.

Why Community Banks?

Attractive Dividend Yields and Valuations

For one thing, many of the banks are in good financial health, and their stocks often pay steady, attractive dividends. We believe that rising earnings, dividend yields and book values provide together a significant tailwind to valuations.

|

Relative Valuation & Yield by Market Cap

|

| Market Capitalization |

Number of Banks |

Dividend Yield (Avg) |

Median Price/ TBV |

| <$100M |

314

|

1.96%

|

114%

|

| $100M – $500M |

224

|

2.33%

|

138%

|

| $500M – $1B |

58

|

2.63%

|

139%

|

| >$1B |

129

|

2.95%

|

196%

|

| Total |

725

|

2.30%

|

138%

|

Source: S&P Global Market Intelligence: SNL Banker. As of 1/31/2023.

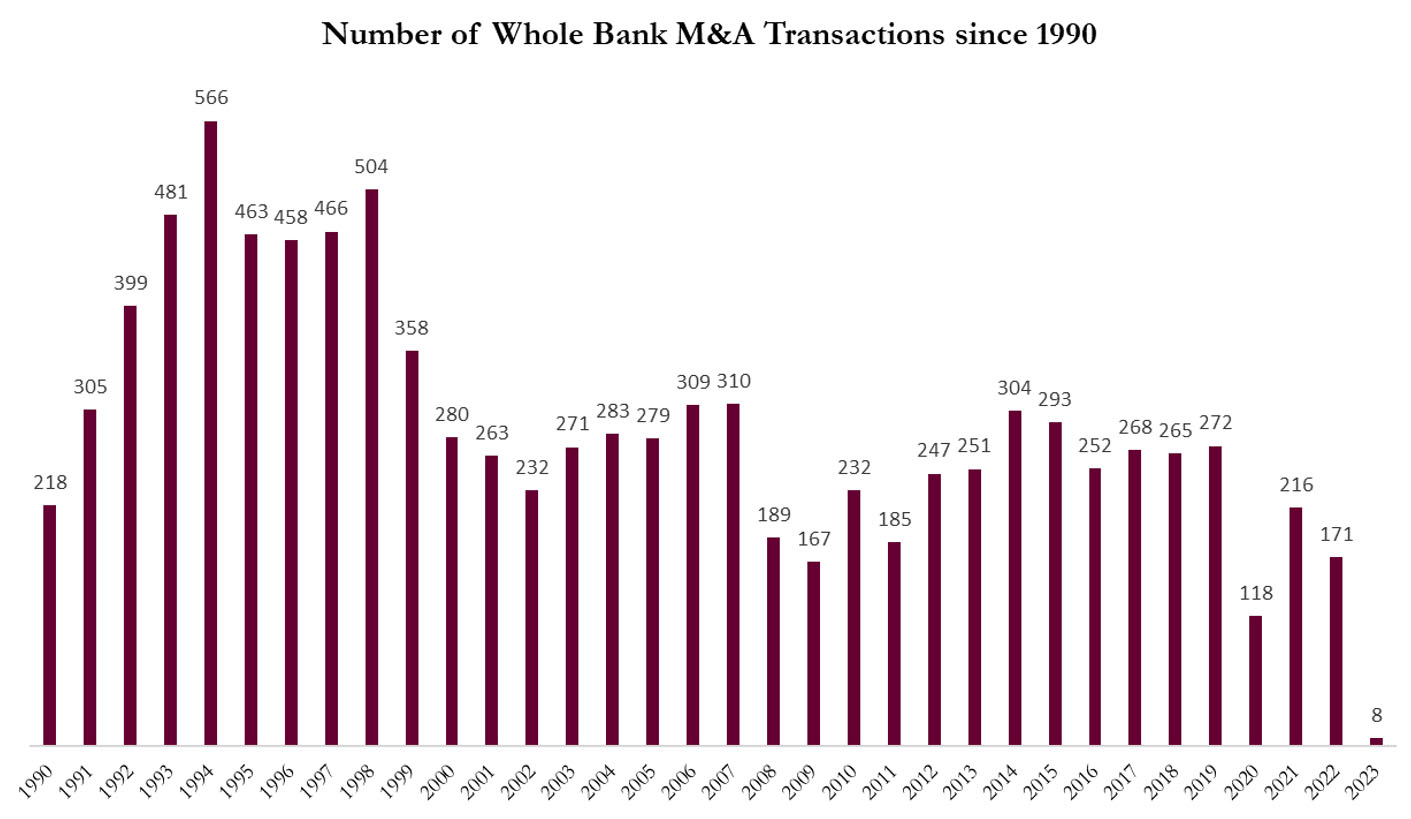

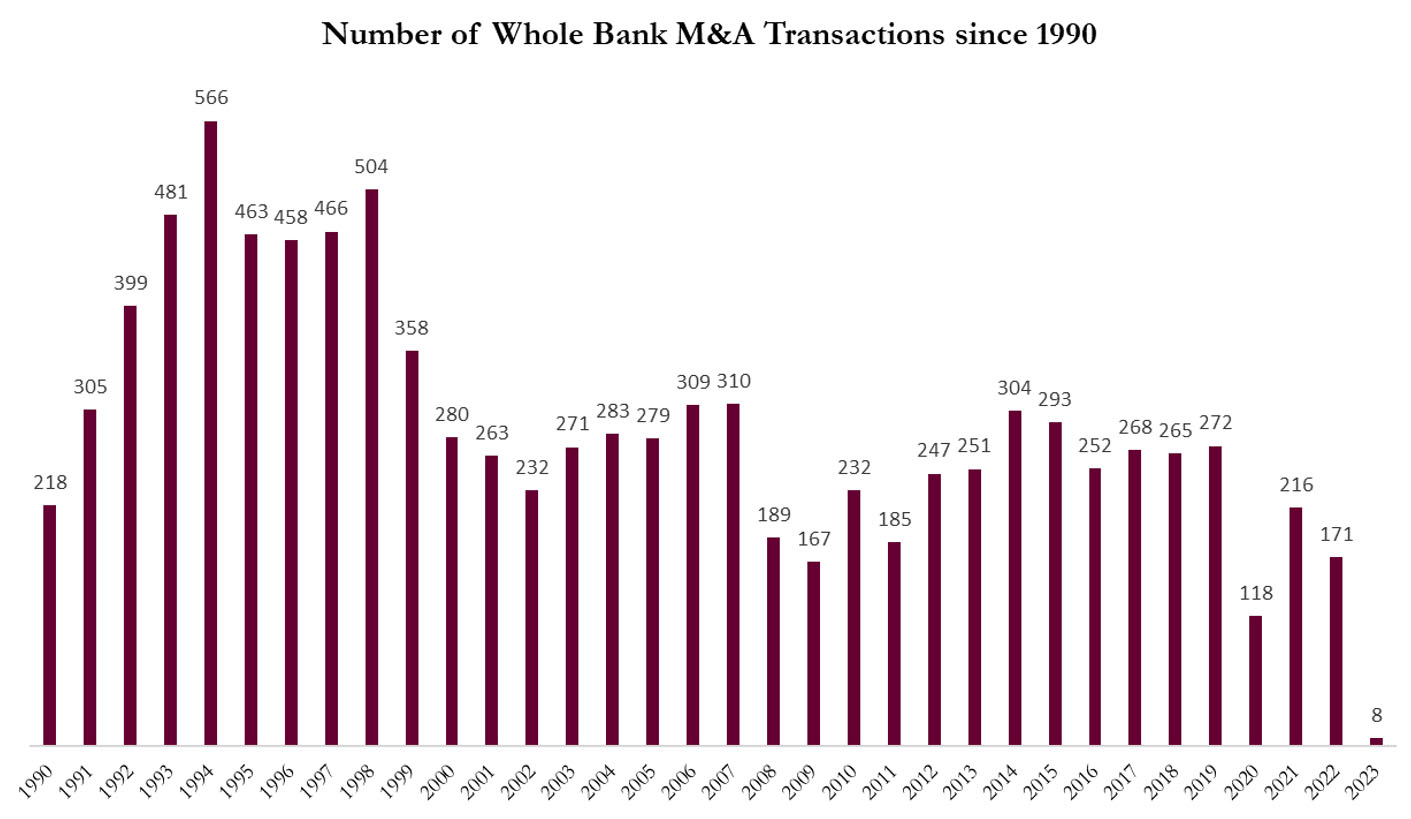

Mergers and Acquisitions

In addition, the continued consolidation of the banking market offers potential benefits. Larger banks often acquire community banks as a way of gaining market penetration, and mergers between community banks are not uncommon because they offer improved operational efficiencies. Both types of transactions can create a significant boost in the share price of a merged or acquired bank.

Profitability measures rise as banks grow assets and achieve scale. This liquidity discount provides incentives for mergers and acquisitions among community banks, as the bank’s return stream is largely dependent on climbing up the capital and liquidity ladder.

Deal Flow

Finally, the number of banks with small market capitalizations allows for an investment universe that is large enough for firms to selectively invest, but also prevents financial industry giants from participating too broadly in the market. This provides opportunities to firms that are active in the market as banks look to climb the aforementioned capital and liquidity ladder.

Investing in Community Banks involves risk. No assurance can be given as to when or whether adverse events might occur in this sector that could cause immediate and significant losses to principle invested due to, but not limited to the following risks: Risks associated with banks loan portfolios, including difficulties in achieving loan growth, greater loan losses than historic levels, an insufficient allowance for loan losses, expenses associated with managing nonperforming assets, the ability to maintain and service relationships with automobile dealers and indirect automobile loan purchasers, and the ability to profitably manage changes in indirect automobile lending operations; Risks associated with global, general, and local economic and business conditions, including economic recession or depression, the pace, consistency, and extent of recovery of values and activity in the residential housing and commercial real estate markets of various local markets, the expectations of and actual timing and amount of interest rate movements, including the slope and shape of the yield curve, which can have a significant impact on financial institutions; Market and monetary fluctuations, including fluctuations in mortgage markets; Inflation or deflation; Risks associated with government regulation and programs, uncertainty with respect to future governmental economic and regulatory measures, new regulatory requirements imposed by the Consumer Financial Protection Bureau (“CFPB”), new regulatory requirements for residential mortgage loan services, and numerous legislative proposals to further regulate the financial services industry, the impact of and adverse changes in the governmental regulatory requirements, and changes in political, legislative and economic conditions; Risks associated with the ability to maintain adequate liquidity and sources of liquidity; Risks associated with the ability to maintain sufficient capital and to raise additional capital; Risks associated with the accuracy and completeness of information from customers and counterparties; Risks associated with the effectiveness of controls and procedures; Risks associated with the ability to attract and retain skilled people; Risks associated with greater competitive pressures among financial institutions in market areas; Risks associated with failure to achieve the revenue increases expected to result from investments in growth strategies, including branch additions and in transaction deposit, trust and lending businesses; Risks related to acquisitions; Compliance with certain requirements under loss share agreements with the Federal Deposit Insurance Corporation (“FDIC”); Risks associated with technological changes and the possibility of cyber fraud; Risks associated with adverse weather events in certain geographic markets; Risks associated with the reliance on financial models and the accuracy of such financial models; and Risks associated with the reliance on third party vendors.